“Consumerism” gets thrown around a lot by the payers, entrepreneurs, brokers and anyone trying to address healthcare members present and future concerns. But what does consumerism really mean?

To me, you need to look no further than the 2017 Annual Kaiser Family Foundation Employer Health Benefits Survey. This study suggests employer healthcare cost-shifting to employees has gone so far and healthcare purchasing is so consumer-unfriendly that a critical tipping point has been reached. Now, consumers are looking for help to make better informed purchasing decisions.

How’d we get here?

With a tight labor market, employers in the late 90’s and early 2000’s had to offer rich benefit plans. With little out-of-pocket cost burden, employees had little need to understand much about their health insurance other than who was in-network. And with POS and PPO plans, referrals weren’t even needed to see specialists.

“Members” (because no one thought of us as “consumers”) didn’t need to consume much information about the healthcare system because all they had to pay was a small copay (maybe), a small deductible (maybe), and low coinsurance (maybe) on services received.

"A KFF study suggests employer healthcare cost-shifting to employees has gone so far and healthcare purchasing is so consumer-unfriendly that a critical tipping point has been reached. "

These super rich plans, along with monopolistic pricing from healthcare providers, led to higher loss ratios and more pricing pressure from insurers. Then a shift started to happen. Over the past 10 years, the average deductible for people on employer provided health coverage rose from $303 to $1,505. Translation? Employees today are now responsible for over $1,500 out of pocket before co-insurance even kicks in, but naturally most are not equipped with an understanding of what services cost or who the best providers are. The Kaiser Family Foundation survey showed 28% of those surveyed had an inadequate knowledge of healthcare to navigate the system.

You wouldn’t hire a lawyer without interviewing them first and finding out their billing rates. You wouldn’t buy a car without test driving it, asking tons of questions and comparing it to other models or brands. You wouldn’t buy a house without the approval of an inspector and the advice of a mortgage broker. Heck, most people don’t even buy health insurance without some level of guidance. But when it comes to healthcare services, which are significantly more important and potentially more expensive than any of the aforementioned items, you blindly go into the system and seek care from whoever will give it to you. The reason? The system is confusing, and years of low deductible, high coinsurance PPO plans have created a member that doesn’t know how to be a consumer. It’s like when you can’t remember the words for things in Spanish despite 4 years of class in high school because you haven’t used Spanish for years.

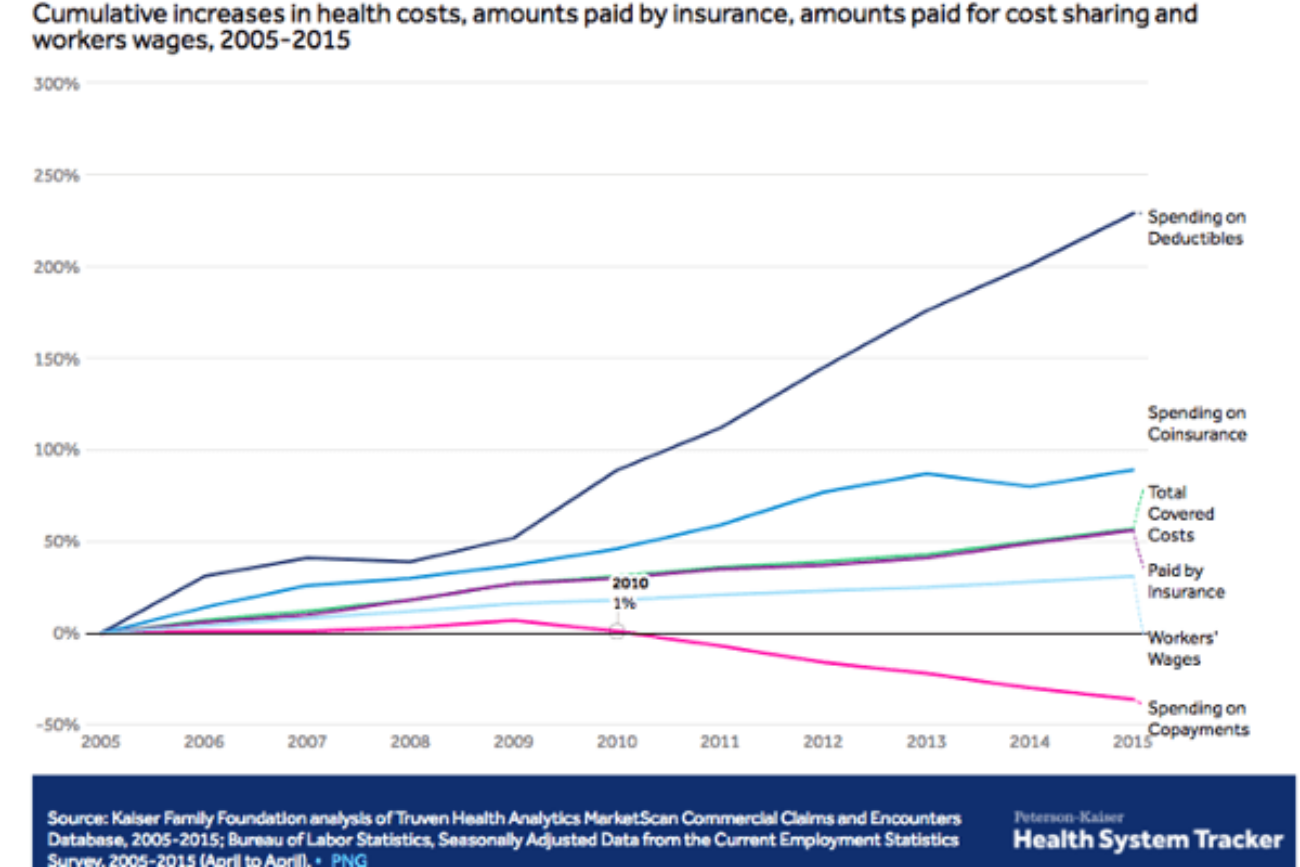

What’s worse? The average overall portion of patient cost sharing rose 66% from $469 in 2005 to $778 in 2015. During that same period, payments by health plans rose only 56%, reflecting a modest decrease in the generosity of insurance plans. Meanwhile, wages only rose by 31% from 2005-2015. So employees now have more financial responsibility for the cost of care, and less money to spend on it relative to the increases.

So employers are to blame?

But can we blame employers? Earlier this year, Warren Buffett called healthcare costs the “tapeworm” of the US economy. Companies still spend on average $12,594 for family coverage for their employees, and healthcare costs are a staggering 17.1% of total GDP. Healthcare costs can be crippling to businesses, and the rising costs over the past 20 years (302%) has forced businesses to seek new plan design options and shift some of the cost burden back onto employees.

So where does this leave us?

Back to consumerism. I’ll be the first to admit that this term has gotten thrown around way too much over the past 10 years – maybe as much as “digital health.” Unlike digital health, consumerism is inevitable. Employers costs continue to skyrocket leaving them with no choice but to shift costs back onto employees in order to make plans more affordable. The government is at a complete standstill as it relates to both healthcare (health insurance) reform and taxes.

So, my prediction is that the trends will continue. Enrollment in HDHP’s has risen from 4% to 29% over the past 10 years and doesn’t appear to be slowing down. Payers are increasingly introducing complex tiered networks and skinny network plans to reduce costs, leaving members more confused and exposed than ever before. Members need to learn to be better consumers.

The good news.

The good news is that there are a lot of companies trying to help change members into consumers. TouchCare provides all members with the tools to be better consumers – extending well beyond price transparency to full on concierge services designed to provide members with a healthier understanding of healthcare. Our Expert Health Assistants are available to help members flip the script on the insurance companies and healthcare providers – empowering them to be consumers in a complex system and ensure they find the right care at the right price in the right network. Leveraging claims data allows us to proactively engage members and our online & mobile tools make being an expert navigator of the health system easy and convenient.

Consumerism in healthcare is real. It’s time for members to take control of their experience and make sure they have the tools & resources necessary to be the expert that this complex system requires.

Rob LaHayne is the CEO of TouchCare. He is a healthcare industry veteran who believes that #realreform comes from a healthier understanding of healthcare. Rob and his family live in New York City.

Inhale. We've got this. Exhale.

Understanding healthcare; with us, it’s personal.